how to pay indiana state taxes quarterly

One to the IRS and one to your state. Based On Circumstances You May Already Qualify For Tax Relief.

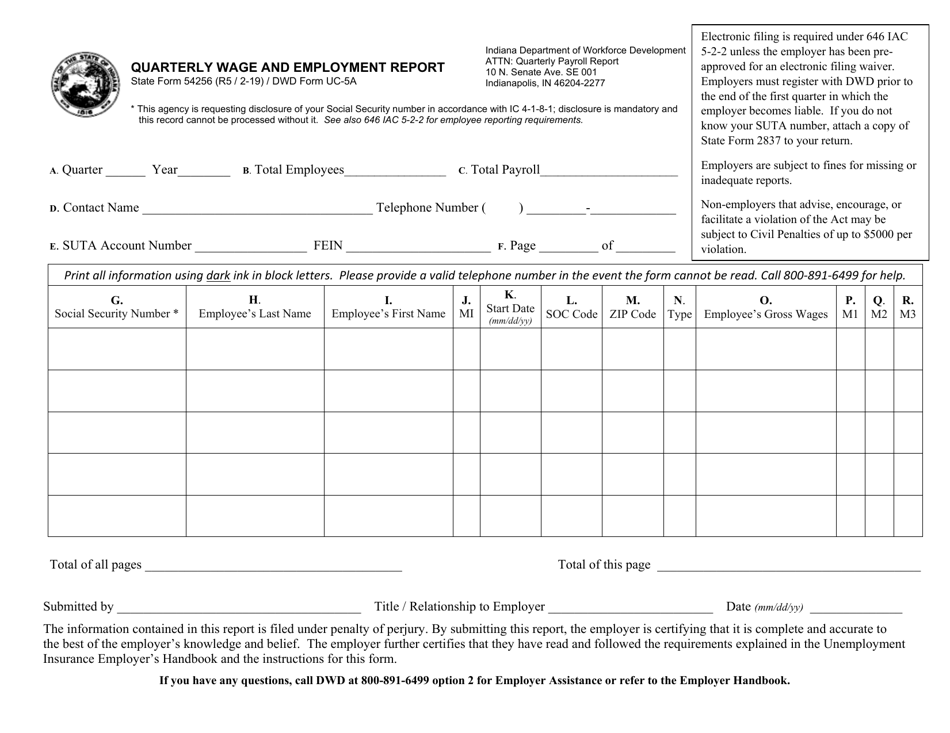

Dwd Form Uc 5a State Form 54256 Download Printable Pdf Or Fill Online Quarterly Wage And Employment Report Indiana Templateroller

Get free competing quotes from the best.

. Ad Dont Let the IRS Intimidate You. How to Pay Quarterly Taxes. Form WH-1 Withholding Tax Voucher for EFT Early Filer Early Filer Monthly Annual filers.

Contact DOR at 317-232-0129 to receive an IT-6WTH coupon if you make monthly or quarterly distributions and are unable to use INTIME. Resolve your tax hardship issues permanently. Should collect Indiana sales tax at the rate the buyer would pay in hisher home state.

This must be completed for OnPay to be able to file and pay your Indiana taxes. Find Indiana tax forms. You can find your amount due and pay online using the intimedoringov electronic payment system.

Have more time to file my taxes and I think I will owe the Department. If you file quarterly your payment schedule is as follows. So if you discover youre required to pay quarterly taxes you must first use Schedule C of Form 1040 to determine how much you owe.

If you did make estimated tax payments either they were not paid on time or you did not pay. 20 Quarter 2 Apr-Jun due Jul. 20 Quarter 3 Jul-Sept due Oct.

Indiana also offers discounts for those who pay their taxes early. Department of Administration - Procurement Division. Taxes should be withheld from a taxpayers paychecks throughout the year at a rate equal to the total of the state and county rate but youll still need to file a state income tax return.

For current balance due on any individual or business tax liability you may call the automated information line at 317-233-4018 Monday through Saturday 7 am. Your payroll software can make the payment on your behalf. Do not staple it to the return.

Register with the. Enter your SSN or ITIN and phone number choose the type of tax payment you want to make and select Next. Both forms will help you determine your net earnings or loss.

File online using. Choose the amount you want to pay and your payment method and select Next. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

If you cannot locate this number please call the agency at 317-233-4016. Pay my tax bill in installments. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Page Last Reviewed or Updated. Review your payment and select Submit. Click on Make Payment or Establish Payment Plan in the navigation bar.

The purchaser will pay the use tax owed on his or her annual Indiana income tax return due April 15. Free Competing Quotes From Tax Relief Consultants. Learn How To File Taxes From A Live Tax Expert With TurboTax Live.

When you filed your state return TT would have told you the various options as follows. Select Individual Payment Type and select Next. There is no standard deduction in Indiana but taxpayers may still claim itemized deductions on their Indiana state income tax return.

Line 26 Amount Due Payment OptionsThere are several ways to pay the amount you oweMake your check money order or cashiers check payable to. If you dont receive 1099s or if you. This means you may need to make two estimated tax payments each quarter.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Claim a gambling loss on my Indiana return. 20 Annual taxes are due on the 31st of January if you file only once per year.

Just include the payment loose in theenvelope. What are the payroll tax filing requirements. You will need to have your taxpayer identification number or Social Security number and Letter ID.

Know when I will receive my tax refund. However if your net earnings equate to less than 5000 you may be able to file a Schedule C-EZ instead. Some states also require estimated quarterly taxes.

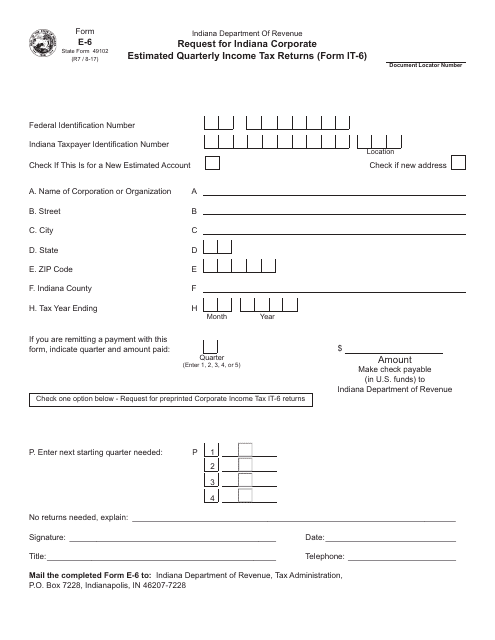

Forms required to be filed for Indiana payroll are. Ad TurboTax Experts Help You Get Every Dollar You Deserve. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest.

Some of the expenses and types of. Learn about state requirements for estimated quarterly tax payments. Indiana Tax ID Number.

Quarter 1 Jan-Mar due Apr. Estimated payments may also be made online through Indianas INTIME website. Line I This is your estimated tax installment payment.

Take the renters deduction. Once registered with the Indiana Department of Revenue they will issue the WH-1s and determine the filing status. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments.

File With 100 Confidence Today. Indiana Small Business Development Center. Usually thats monthly or quarterly.

Its common to pay your SUTA taxes with your employees state income tax withholding. Under Quick Links select Make a Payment. In order to pay individual state of Indiana income tax please follow the following steps.

Put together all of your Form 1099-NECs to add up your total nonemployee compensation. Tally Up Your Income. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form.

Youll be redirected to InTime or the Indiana Taxpayer Information Management Engine. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. 2 days agoHeres an overview of the process.

The tax bill is a penalty for not making proper estimated tax payments. Completing Form ES-40 and mailing it with your payment. You can find your Indiana Tax ID number on notices received from the Indiana Department of Revenue.

20 Quarter 4 Oct-Dec due Jan.

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

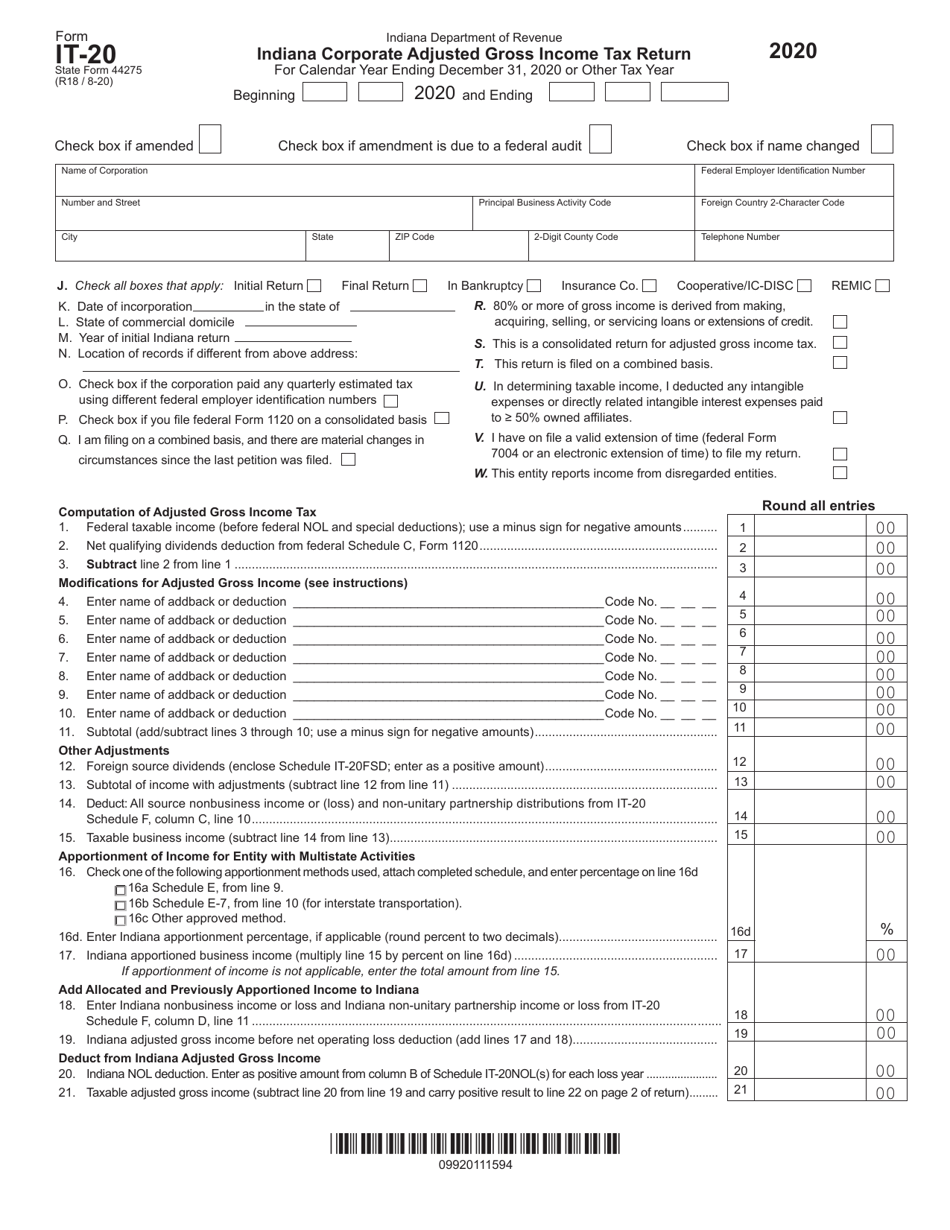

Form It 20 State Form 44275 Download Fillable Pdf Or Fill Online Indiana Corporate Adjusted Gross Income Tax Return 2020 Indiana Templateroller

How To Pay Indiana Taxes With Dor Intime R Indiana

Indiana Estimated Tax Payment Form 2021 Fill Online Printable Fillable Blank Pdffiller

A Complete Guide To Indiana Payroll Taxes

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Dor Make Estimated Tax Payments Electronically

.png)

Quarterly Tax Calculator Calculate Estimated Taxes

Indiana Taxes For New Employees Asap Payroll Services

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Dor Keep An Eye Out For Estimated Tax Payments

Indiana Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller